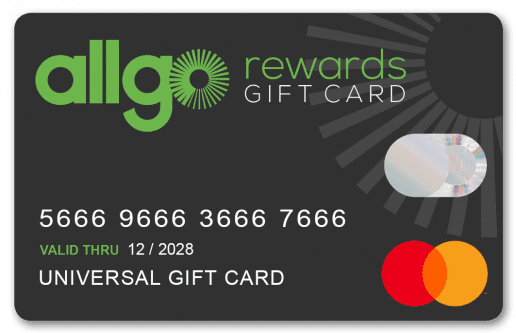

Allgo Mastercard Gift Card

The universal gift card that can be used wherever Mastercard® is accepted. Tax-free up to €1,000 on the Small Benefit Scheme.

€1,000 Small Benefit Scheme

Find out everything you need to know about the Revenue scheme to reward employees in Ireland tax-free up to €1,000 per year

Employee Recognition

Allgo’s Recognition Hub platform is a powerful, world-class system to engage your employees around your company values and goals.

Maximise Results

Incentivises can align the key people in your business – employees, channel partners, or customers – with your company goals….

Improve performance. Empower change.

Inspire success.

Allgo helps companies engage, motivate and reward people to achieve great results. We provide expertise, technology, and rewards to enable companies achieve strategic objectives through world-class incentives, rewards and recognition programmes.

Reward

Success

Thank staff, customers and channel partners with rewards that are truly appreciated.

Recognise

Employees

Thank your staff and engage and motivate them around your company values and goals.

Incentivise

Results

Maximise performance in your business with an incentive that delivers results.

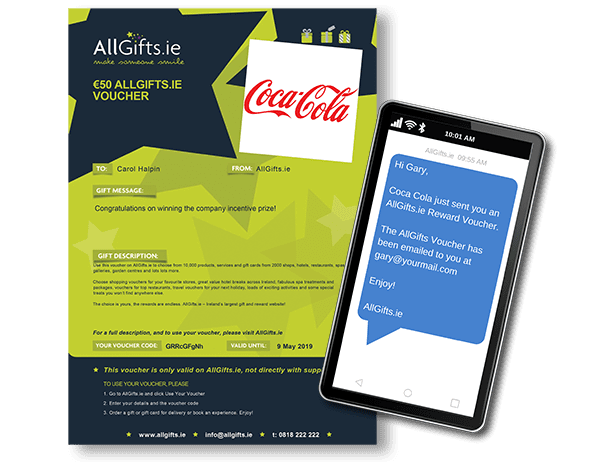

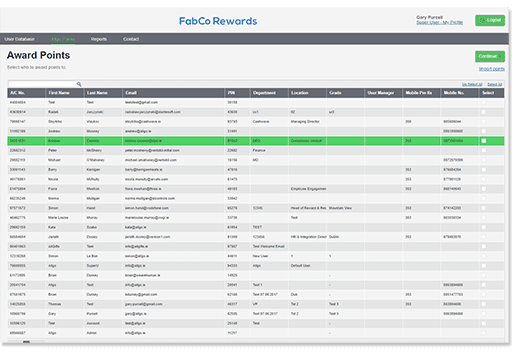

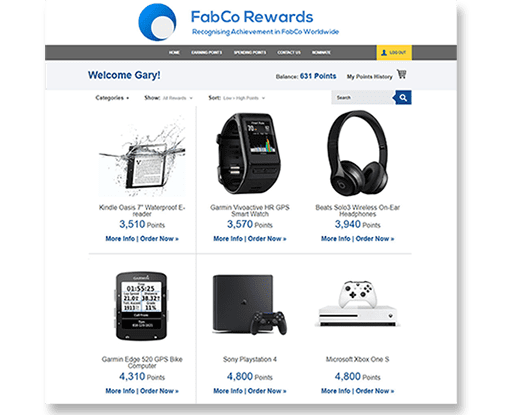

Popular Products

Allgo offers an extensive range of reward, recognition and incentive products and services. Here are some of our most widely used –

We help the best

perform better

Allgo’s numerous clients across all industry sectors have one thing in common – they look to Allgo to provide the ideas, systems and management to incentivise and reward performance and drive results in their businesses.

Video Intro to Allgo Rewards

From rewards to recognition, from service awards to sales incentives, from tax-free gift cards to tax-free points programmes.

Allgo has the experience, technology and gift cards to get people (all)going!

Watch Video – We are allgo!

We are Allgo

and we want your company

to be Allgo too!

Allgo started life in 2008 with AllGifts.ie, our consumer and SME-focused gift & reward site. Since then, we’ve been on journey to become an award-winning international incentive marketing company, with a suite of products that offer best-in-class incentives, rewards & recognition.

In everything we do – from the people we hire to the services we run – we try to follow our 3 core values:

1. PROACTIVE

Taking Personal Ownership | Showing Initiative | Being innovative

2. PROFERSSIONAL

Producing Quality Work | Being Super Responsive | Being Open & Honest

3. POSITIVE

Doing something positive for The Environment | Customers | The team

Expert Insights

Latest Guides, Surveys, and Reports

Definitive Guide to Performance Incentives

Performance incentives encourage higher performance among your employees by offering rewards (either cash or non-cash) for achieving pre-defined performance measures (such as sales targets). While there is some overlap, bonuses differ from…

HR Manager’s Guide to Employee Engagement

High Employee Engagement in an organisation is a key indicator of company performance, and can make a significant difference across a host of business criteria, including: Download our lasted eBook “The HR Manager’s Guide…

How Employee Rewards can help Recruitment & Retention

With the unemployment rate down to 6.2%, the lowest rate for 10 years, it is no surprise that Recruitment & Retention will be the Top 2 HR Challenges in Ireland this year….